This week we focus on the main schemes available to help employees, workers, the self-employed and small businesses through the pandemic.

Help for workers & employees

Extended Job Retention Scheme (‘furlough’) – for workers unable to work due to partial or full closure of their workplace

The Government will cover 80% of wages for hours not worked, up to £2,500 per month. Employers must pay National Insurance and pension contributions. Employees can work part-time – employers must pay normal pay for all hours worked. The employee must have been on the payroll before 30.10.2020. The Job Retention Scheme will last until 31.3.2021.

Statutory Sick Pay (SSP) – for employees unable to work due to sickness, self-isolation or shielding

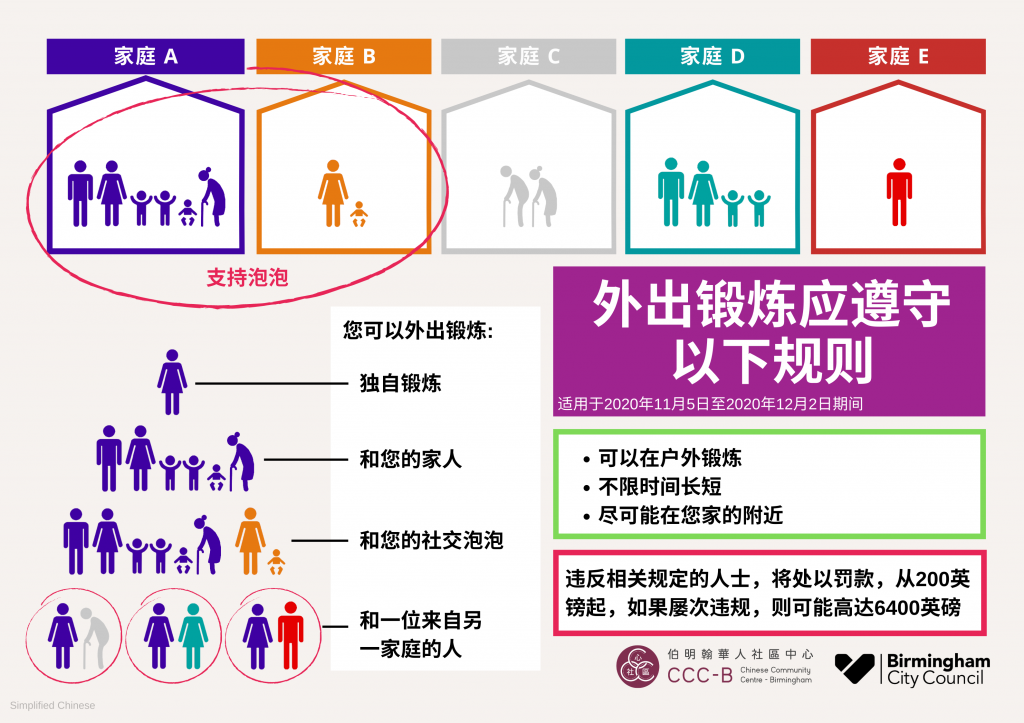

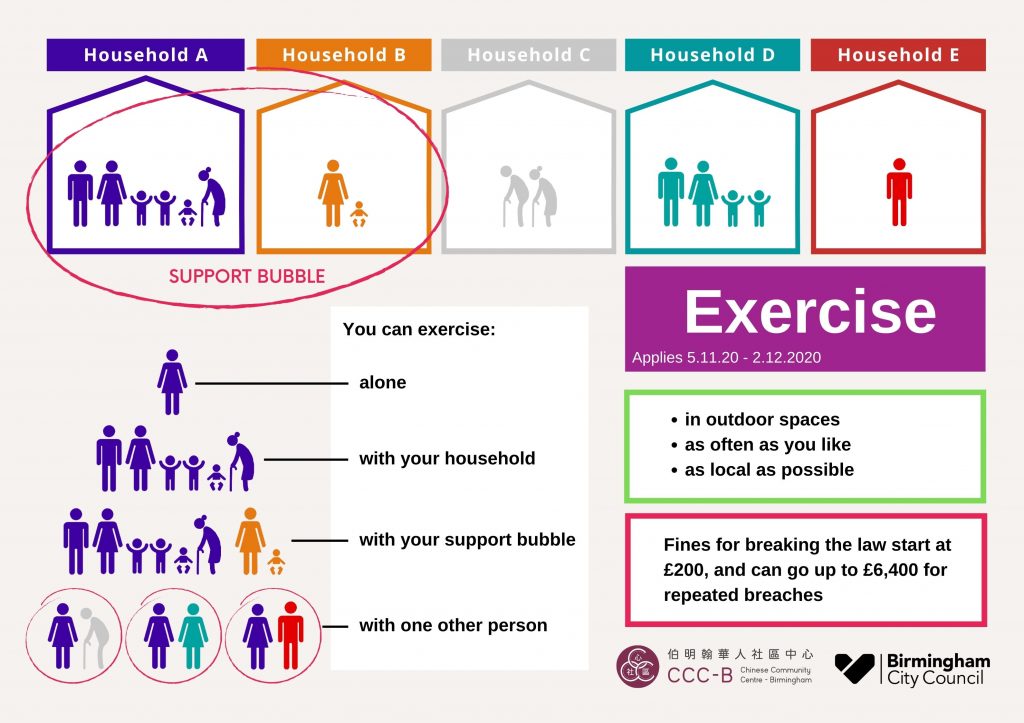

SSP is payable if you are an employee with average earnings £120 per week AND you cannot work because of illness. SSP is paid by the employer. If you or somebody in your household/support bubble has Covid symptoms or a positive Covid test result OR NHS Test & Trace have instructed you to self-isolate OR you cannot work because you are shielding, SSP is paid from day one. If you have a non-Covid illness, SSP is paid after 4 ‘waiting days’. You cannot claim SSP if you are in quarantine after returning from abroad.

Self-isolation support payment for workers on low incomes

If you are employed or self-employed in receipt of a qualifying benefit (see below), have a positive Covid test result or a notification from NHS Test & Trace to isolate AND are unable to work from home, you can apply for a one-off lump sum of £500.

Qualifying benefits:

- Universal Credit

- Working Tax Credit

- Income-based Employment & Support Allowance

- Income-based Jobseeker’s Allowance

- Income Support

- Housing Benefit

- Pension Credit

There is also a discretionary payment scheme for working people who are not in receipt of any of the qualifying benefits

Claim via the Council’s website: https://rebrand.ly/cmsq8 In order to claim, you must have a unique 8-digit reference number provided by NHS Test & Trace. You must have a bank account to receive the payment.

You can claim the £500 payment for each time you are required to self-isolate. Members of your household can also claim if they meet the criteria.

These payments are designed to stop transmission of the virus by encouraging workers to self-isolate if they have symptoms or a positive Covid test result. They provide some financial support if you are unable to work from home and would lose income.

Our Advice & Advocacy Service can advise and help you make claims. Call 0121 685 8510 for appointments and details of our fees.

Remember that it is a legal requirement to self-isolate if you are notified by NHS Test & Trace. You can be fined £1-10K for failing to stay at home.

Help for the Self-Employed

Self Employed Income Support Scheme (SEISS) – extended

The SEISS is intended to support viable traders who are facing reduced demand due to lockdown. The Government will pay self-employed workers a taxable grant worth 80% of average trading profits for the period November-January, capped at £7,500. You must have submitted your 2019 tax return. You will be able to claim from 30.11.2020. A second grant covering February-April will be available – details to be announced.

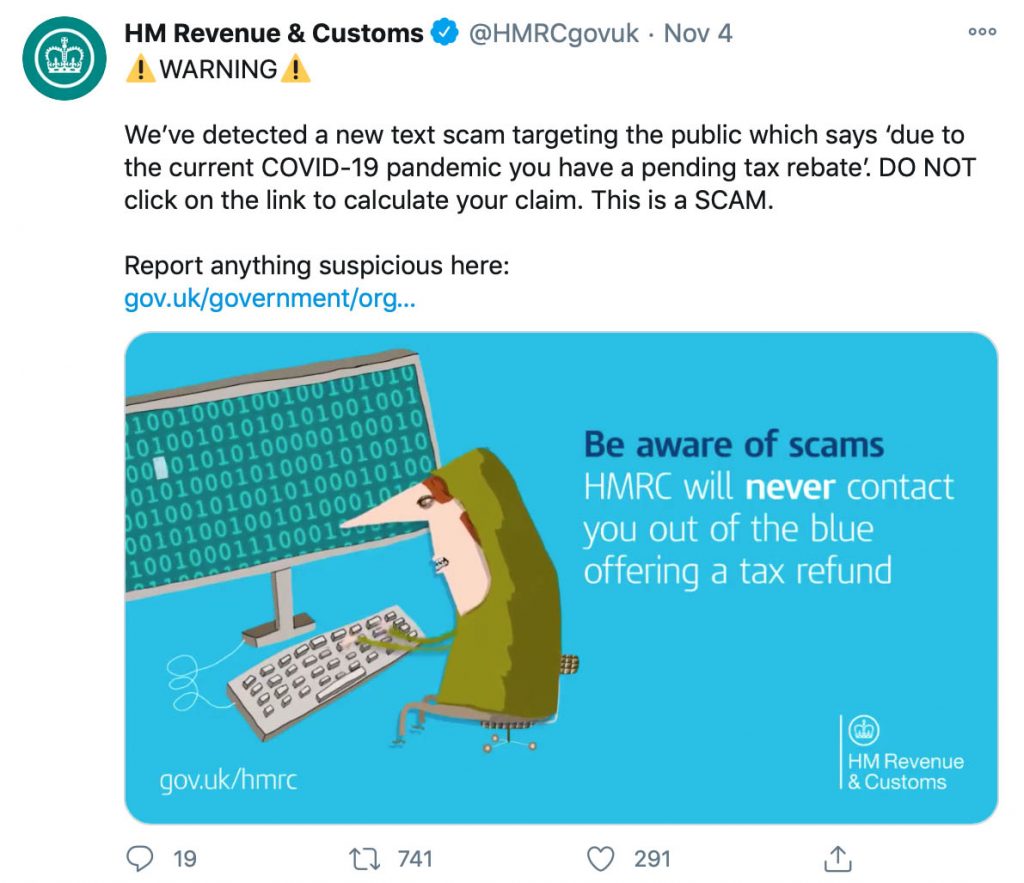

Please heed HMRC warnings about scams. You should only respond to messages in your Government Gateway.

Deferred self-assessment income tax payments

Self-employed people will be able to defer income tax payments that were due to be paid in July this year to January 2022, an extension of 18 months. You do not need to request this – HMRC will offer the extension to you.

Universal Credit for self-employed people unable to work due to illness

Self-employed people who have Covid symptoms or are self-isolating may claim Universal Credit

Support for small businesses

Local Restrictions Support Grants (LRSG)

For businesses that

- provide face-to-face services to customers on-site AND

- were trading as normal before Tier 2 restrictions were imposed on 9.9.2020 AND

- were forced to close for at least 3 weeks when Birmingham was placed in Tier 2 High Alert Level AND

- pay business rates on their premises

The Council will pay a grant of £1000 per 3-week period starting 9 Sep will be paid to business with a rateable value (RV) below £51k + £1,000 for each additional 3-week period.

A grant of £1,500 per 3-week periold for businesses with a RV above £51K + £1.5k for each additional 3-week period

Applications for LRSGs will be made to the Council via its website https://bit.ly/38zqnrA

Your business is not eligible if

- You can continue to operate because your business is not customer-facing

- You closed by choice, not because you were required to

- You were not permitted to open anyway

Other financial help from the Government

To find out what other financial help is available for small businesses, use the Government tool https://rebrand.ly/pzlj9

Sources

Gov.UK https://bit.ly/2UnRbTd

Birmingham City Council https://bit.ly/3ktx7JC

Greater Birmingham Chamber of Commerce https://bit.ly/2JZwHy9

Charity Tax Group https://bit.ly/3eZr4vA

News

Vaccine trial

On Monday 9.11.2020, US pharmaceutical company Pfizer announced ‘first ‘milestone’ vaccine offers 90% protection’ https://www.bbc.co.uk/news/health-54873105

There are still many questions including long term immunity, and the British Government has stated that the vaccine must pass UK safety tests before it is licenced for use here. However, it is widely seen as good news. The Government is working out the priority list for who receives the vaccination – we hope to report this in the next Update.

- The vaccination will not be compulsory

- The Pfizer vaccination will not be given to children

Home test kits

The Government has engaged credit reference agency TransUnion to process orders for home testing kits. This is to prevent fraud and multiple ordering. People with no credit history in the UK have been unable to get a home testing kit. Going to a walk-in or drive-through test centre are the only options.

https://www.bbc.co.uk/news/business-54841185

To get a free NHS test, call 119 or book online

https://www.gov.uk/get-coronavirus-test

The test is only free if you have symptoms.

Survey

Councils in the West Midlands have issued a survey to test opinion on testing and vaccination.

https://www.smartsurvey.co.uk/s/L37ZXT/

The R number in Birmingham is currently 1.3

To check case and death rates http://ukcovid19.nw.r.appspot.com/

每周疫情快讯: 2020年11月6日

本周,我们重点介绍政府对受雇人士、雇员、自雇人士、个体经营者和小型企业在疫情期间的补助计划。

给予受雇人士和雇员的补助

“职位保留计划”将被延长 – 适用于因工作场所部分或全部关闭而无法工作的受雇人士

政府将支付雇员未工作时间部分80%的工资,每月上限为2,500英镑。雇主必须支付员工的国民保险和退休金。雇员可以兼职,雇主必须按正常工资的标准支付员工已工作的时间,符合申请资格的雇员必须是在2020年10月30日之前已经在英国税务局纳税系统(PAYE)登记注册。职位保留计划将延续至2021年3月31日。

法定病假工资(SSP)–适用于因疾病,自我隔离或屏蔽而无法工作的员工

如果您的员工每周平均收入约为120英镑,并且因生病而无法工作,该员工符合支付法定病假工资的条件。法定病假工资由雇主支付。 如果您或您的家庭/支持泡泡中的有人出现新冠症状或新冠测试结果呈阳性,或者NHS测试与追踪部门要求您进行自我隔离,或者您因为居家屏蔽而无法工作,法定病假工资从第一天开始计算。 如果您患有新冠肺炎以外的其他疾病,法定病假工资则需要在4个等待日后开始支付。 如果您是从国外回来后需要居家隔离,此类情形则不能申请法定病假工资。

测试和追踪隔离补助金以支持低收入人士

如果您是受雇或自雇人士,并已经领取以下任意一种福利(请参阅下文),当您新冠测试结果为阳性或NHS 测试与追踪部门通知您进行自我隔离,并且您无法在家工作,则可申请一次性500英镑的隔离补助金。

符合申请条件的福利包括:

- 统一津贴

- 工作退税金

- 失业救济津贴

- 就业收入补助津贴

- 低收入补贴

- 住房津贴

- 养老金补助

对于没有领取任何以上福利的低收入人士,可以申请因特殊情况酌情考虑的补助金

通过政府网站进行申请:https://rebrand.ly/cmsq8 申请时,您必须提供NHS测试与追踪部门发送给您的8位参考编号,同时您还需提供您的银行帐户以便收到补助金。

当您有超过一次或多次自我隔离的情形时,您可以每次自我隔离时申请500英镑的隔离补助金。 如果您的家庭成员符合标准,也可以提出申请。

隔离补助金旨在通过鼓励工作人士在出现新冠症状或新冠测试结果呈阳性时进行自我隔离,从而来防止病毒的传播。 如果您无法在家工作并失去收入,

隔离补助金可以为您提供一些财务支持。

我们的远程咨询服务可以为您提供建议和帮助您申请隔离补助金。 欢迎致电0121 685 8510预约,并查询远程咨询服务的收费标准。

请注意,如果NHS 测试与追踪部门通知您需要自我隔离,您必须按法律规定进行自我隔离。如果您拒绝自我隔离将被罚款。罚款起价为1,000英镑,最高可达10,000英镑。

给予自雇人士补助

自雇人士补助金 – 将被延长

自雇人士补助金旨在为因受封城影响,其业务需求和交易额减少的个体经营者提供支持。在11月至1月期间,政府将向自雇人士支付其业务平均营业利润的80%,最高限额为7,500英镑,补助金属于纳税收入。您必须提交2019年度的纳税申报表。您将可以在2020年11月30日起,提出申请。第二笔补助金的期限从2021年2月开始到2021年4月底的三个月期间,详细信息将在近期发布。

英国税务局HMRC提醒您当心欺诈 – 您只需要在政府在线服务Government Gateway注册的帐户中与英国税务局HMRC进行回复或联络。

自我评估所得税延期

自雇人士可以将原定于今年7月需支付的所得税付款延迟到2022年1月,延长18个月。您无需提出递延申请- 英国税务局HMRC将给您延期。

因疾病而无法工作的自雇人士可以申请统一津贴

有新冠症状或自我隔离的自雇人士可以申请统一津贴

对小型商业/企业的援助

伯明翰商业支持补助金

申请条件

- 为客户提供面对面现场服务的企业或商户

- 在2020年9月9日伯明翰开始实施第2级疫情警戒系统之前,正常交易的企业或商户

- 在伯明翰实施第2级疫情警戒,被迫关闭至少3周的企业或商户

- 其所在物业需要营业税

从9月9日起, 政府将向应税营业额低于51,000英镑的商户或企业每3周支付£1000补助金,之后将每3周支付1,000英镑

应税营业额高于51,000英镑的商户或企业,政府将支付每3周1500英镑的补助金,之后将每3周支付1,500英镑

商业支持补助金可以通过以下政府网站申请

以下情况不符合申请条件

- 您可以继续经营,因为您的业务不需要直接面见客户

- 您不是被政府要求停业,而是自己选择停业关闭

- 疫情期间,您的业务一直不允许对外开放

政府提供的其他财政援助

要了解有关对小型企业的其他财政援助,请在政府网站查询https://rebrand.ly/pzlj9

其他信息资源

Gov.UK 英国政府网站 https://bit.ly/2UnRbTd

Birmingham City Council伯明翰市政府 https://bit.ly/3ktx7JC

DWP就业和养老金部 https://bit.ly/2GYsMkf

Greater Birmingham Chamber of Commerce大伯明翰商会 https://bit.ly/2JZwHy9

Charity Tax Group慈善税务联盟 https://bit.ly/3eZr4vA

新闻

疫苗试验

2020年11月9日星期一,美国制药公司辉瑞公司宣布首款“里程碑”疫苗可提供90%的保护” https://www.bbc.co.uk/news/health-54873105

对于疫苗大家仍有许多疑问,比如长期免疫效果如何。英国政府已声明,疫苗必须先通过英国安全测试,然后才能在英国使用。 总体来说,疫苗的上市是一个好消息。 政府正在制定谁接受疫苗接种的优先次序 – 我们希望在下一次疫情快讯中报告。

- 不会强制民众接种疫苗

- 辉瑞疫苗不会为儿童接种

家庭新冠病毒检测包

政府已聘请信贷咨询机构TransUnion处理家庭新冠病毒检测包的订单。 这是为了防止欺诈和多重订购。 在英国没有信用记录的人无法获得家庭病毒新冠检测包,他们唯一的选择是去步行检测点或驾车检测点进行检测。

https://www.bbc.co.uk/news/business-54841185

需要获得NHS免费新冠病毒的测试,请致电119或在线预订https://www.gov.uk/get-coronavirus-test

只有当您出现新冠症状时才可以进行免费测试

问卷调查

West Midlands议会发布了一项问卷调查,以听取大众对新冠测试和疫苗接种的意见。

https://www.smartsurvey.co.uk/s/L37ZXT/

伯明翰目前的传染率R值为1.3

点击链接查看确诊病例数和死亡数

http://ukcovid19.nw.r.appspot.com/